If you are here in search of Alternatives of Wise then you are on the right page as we include all the substitutes and answers.

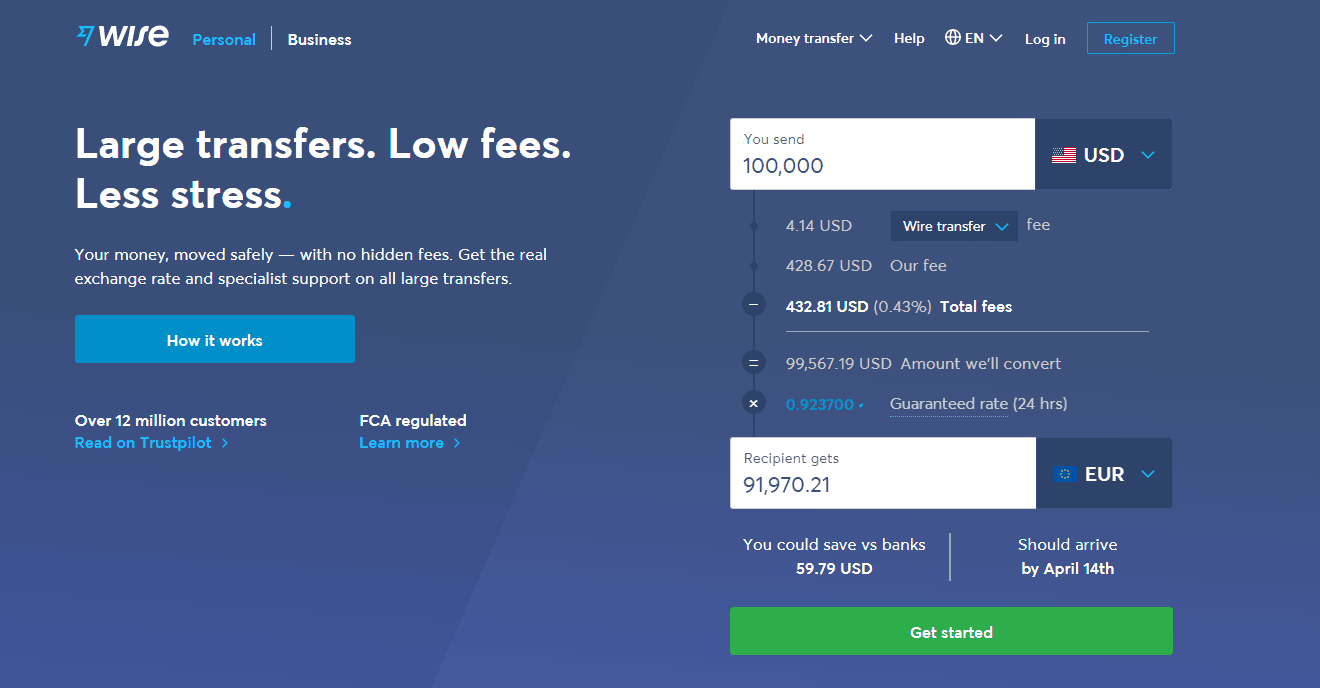

Wise (previously TransferWise) is noted for its openness, low exchange rates, and multi-currency capabilities — perfect for ex-pats, tourists, and expanding enterprises.

There is more to money transfers than just sending and receiving cash. Do you want to donate money more quickly? Is there a way of payment you prefer?

Alternatively, you may require the ability to send big quantities of money quickly and reliably. Is there someone you can turn to for help? We’ll show you the best 7 Wise alternatives. It’s time to get to work!

Best Wise Alternatives: When Wise Is Right For You And When It’s Not?

Transferring money internationally and managing it is easy with Wise, especially if you want to send anything below $7000 USD. ($7000 USD = Approx €6000 EUR, £4000 GBP, $10000 CAD, $10000 AUD, ¥800,000 JPY, $10000 SGD,, ₹500,000 INR).

When It’s Right:

Let’s have a look at the prospects that when to use it.

1. For individuals, sending amounts less than $7000 USD

Wise has one of the best exchange rates for quantities under $7000 USD, according to our own market analysis. I recommend using their fee calculator (which opens in a new tab) to get an idea of what they charge before proceeding forward.

Take note of it so you can compare it to the examples we’ll be discussing in a minute. Generally speaking, we’ve found that fees are always reasonable and clearly stated. Amount, currency, and payment type all influence fees.

For example, the flat charge is roughly $0.90 USD for sums below $7000 USD, while the percentage fee ranges from 0.35 percent to 1.5 percent depending on the amount and currency. They have local bank accounts in all of their service locations, so there are no hidden fees.

2. For expatriates, tourists, and anyone who makes money from outside of the United States.

You’ll pay a lot more in fees and currency rates if you frequently transfer money back to your family from abroad! In terms of convenience and cost, Wise is an excellent choice.

For ex-pats who require banking functions in a new country to pay rent, purchase groceries, or receive money like a local, Wise’s Multi-Currency Account (review) and related Wise card (review) (which works excellent as a travel currency card) are very beneficial (Wise offers international bank details in 10 currencies).

Wise Vs. Payoneer is a good place to see how Wise stacks up against the competition when it comes to receiving and sending money. These capabilities are useful for foreign people who need the ability to manage multiple currencies from one account.

When It Isn’t:

Here are the prospects that when wise is not made for you.

1. For shipments above USD $7000

Wise gets more complicated when dealing with enormous volumes. More rules are being imposed on the financial services industry as a whole due to anti-money laundering (Wiki) and anti-terrorism legislation (Wiki).

Although they make it easy to join up for little sums, Wise’s pros can rapidly turn into drawbacks because of their online-focused experience. If a user wants to send more money, they will have to provide more information and go through more processes to verify their identification.

Some clients may experience account freezes or transfer delays as a result of this. For those who need money transferred quickly and are concerned about where a major portion of their money has gone, this can be a huge disappointment

But there’s more: Calling someone might go a long way in solving problems like constraints your bank may put on your account (due to the same regulations). This is a time and stress saver.

We prefer services whose services and prices are built from the start to get cheaper (in percentage terms) as the sums grow, while Wise is aiming to make their fees more competitive for greater amounts.

Time will tell whether Wise is up to the task. Our recommendation is based on the fact that they have a long history of specializing in smaller, more competitive transfers, and I hope they don’t try to do too much and lose their expertise in the future.

2. For cash transfers

If you want to transfer money from one bank to another, you’ll need to use Wise. In this case, Wise isn’t the best option for you. Wise alternatives (below) for cash transfers can be found in this section.

3. For instant transfers

If you’re wanting to send money instantly (within minutes or hours), Wise is unable to assist you.

While they make every effort to send your money the same day they convert it, the conversion procedure can take up to two days (depending on the currency pair). If quick transfers are a priority for you,I have a handful of excellent alternatives.

4. You require a broader range of receiving countries

While Wise offers money transfers to over 60 countries, your currency may not be supported. Additionally, some of the numerous currencies offered by Wise can be transferred only locally.

Therefore, if your preferred receiving currency is not supported by Wise, it’s worth exploring other providers with a larger international receiving base.

5. You require telephone assistance while enrolling or initiating your transfer.

While Wise’s customer support is generally excellent, the platform is only available online.

Therefore, if you require additional assistance (such as interacting with a human over the phone) in order to complete your transfer (particularly large transactions above $7000 USD), Wise is not the ideal service for you.

And, because Wise is a low-cost service, their customer care (albeit quite prompt) cannot assist you in arranging transfers or customizing services.

Also, Read This:

7 Best Alternatives Of Wise 2026

Let’s have a look at the various alternatives which give equal competition to Wise in terms of features.

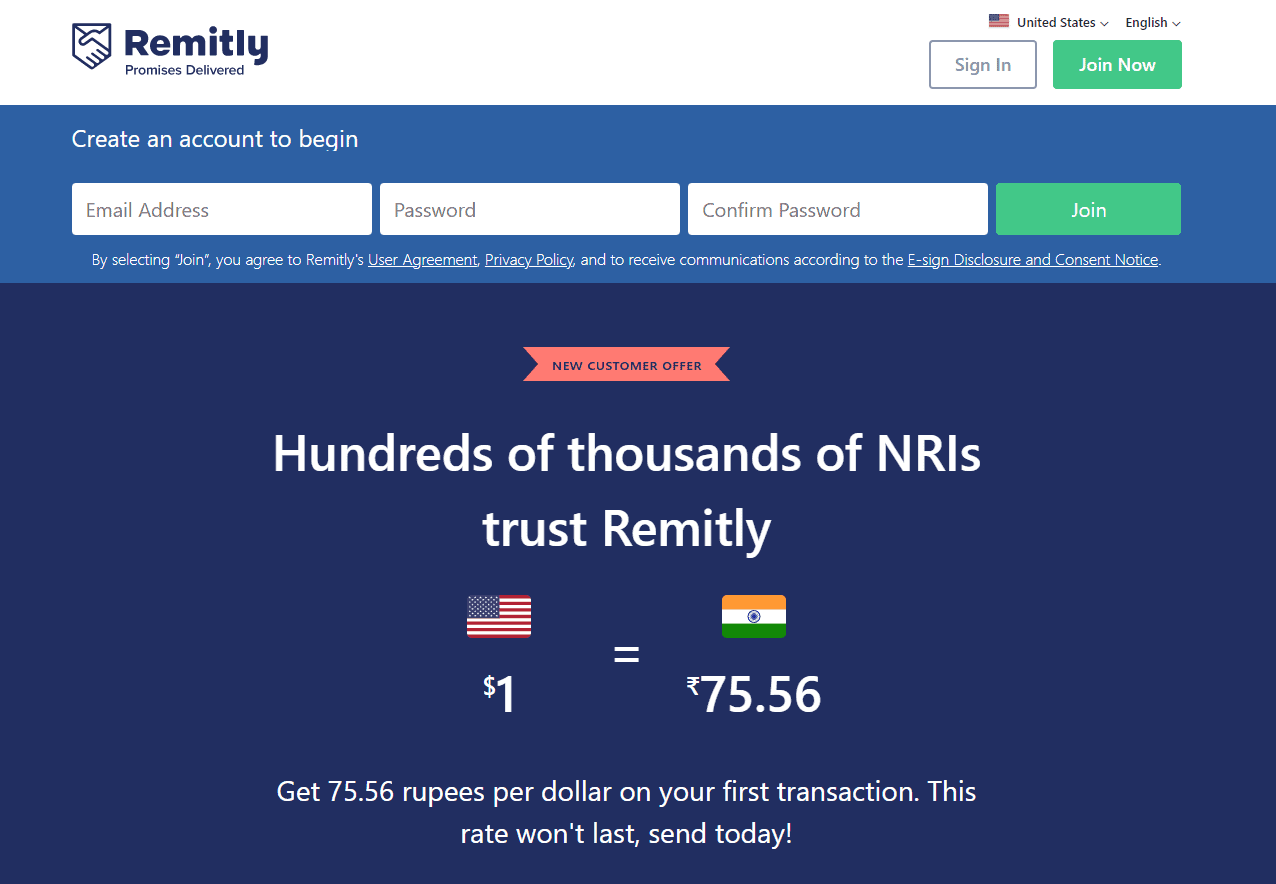

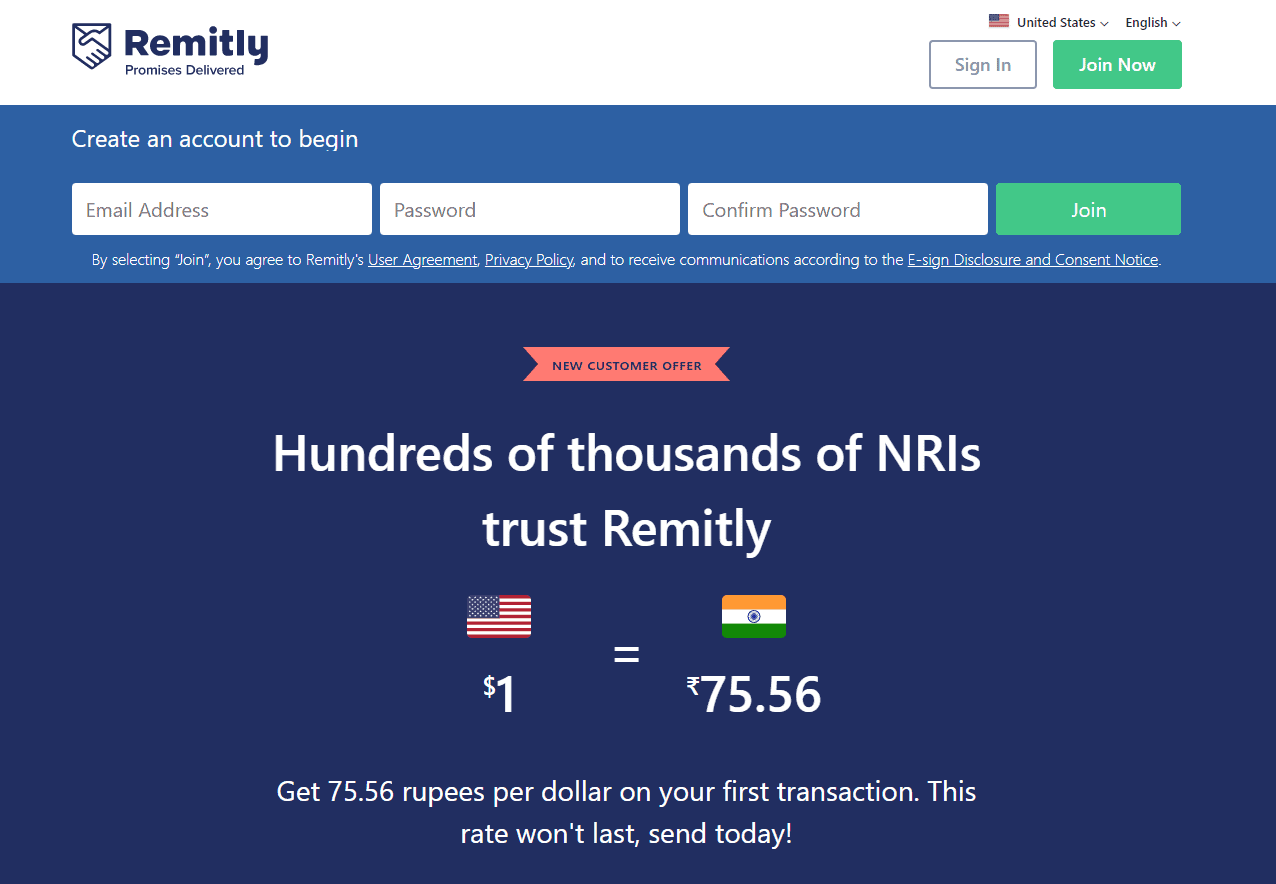

1. Remitly — Small amounts home, fast

Remitly (review) enables transfers between 16 wealthy countries (including the United States, Canada, and the United Kingdom) and more than 50 underdeveloped countries.

They are an international money transfer organization with a singular mission: to assist expatriate workers in sending money home quickly and affordably. Their primary concentration is on small-value personal transfers.

The best features are the following:

- For an extra cost, transfers can be accomplished within hours.

- Money can be received in a variety of ways (direct deposit, cash pick-up, mobile wallet transfer, cash home delivery)

- Remitly is currently running a limited-time new customer promotion. You can view what you receive online (desktop) or download the mobile app for iOS or Android.

Fees: Remitly’s fees vary according to the amount, currency, and service selected. They charge a set fee and a percentage of the exchange rate as a margin.

Remitly even waives the flat charge for some currency combinations (for example, USD to INR) if you send more than $1000 USD. Their Express service enables you to send money within minutes or hours (depending on the receiving country), while their Economy service is a cost-effective way to send money home when you’re not in a rush.

Additional fees to be aware of include credit card fees (3%) for their Express service and fees levied by an intermediary or receiving bank.

Support: Online chat or telephone troubleshooting (in English and Spanish)

How does Remitly stack up against Wise?

Remitly is comparable to Wise in terms of fees and currency rate (although I have found Wise to be slightly cheaper generally). However, Wise’s pricing structure is more transparent, as you will know the actual amount the receiver will receive when you click “send.”

With Remitly, there are some occasions when you may be charged an unexpected fee if the transfer is funded via a bank account (banks on either side might charge their own fee).

Use Remitly if:

You reside and work in one of the 16 recognized countries AND you require the ability to send money promptly if necessary (and can finance the transfer with a credit card) OR you require the receiver to pick up cash.

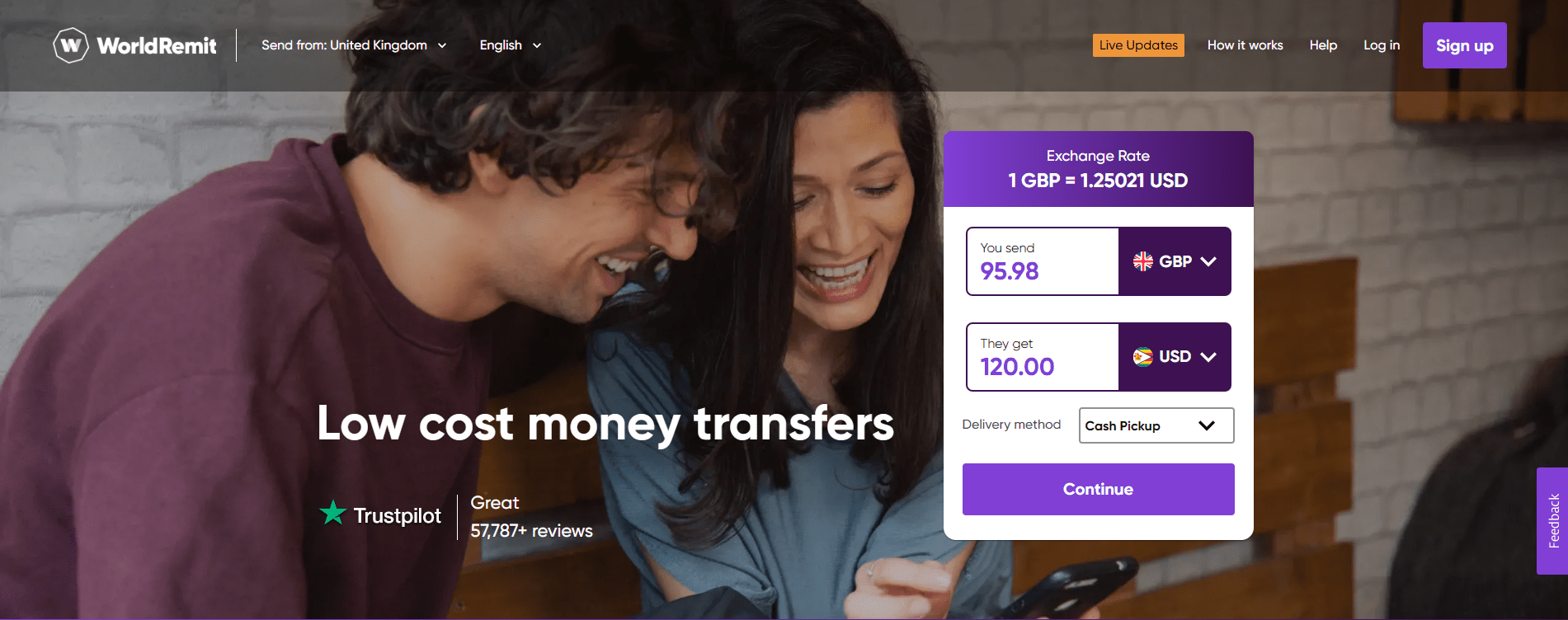

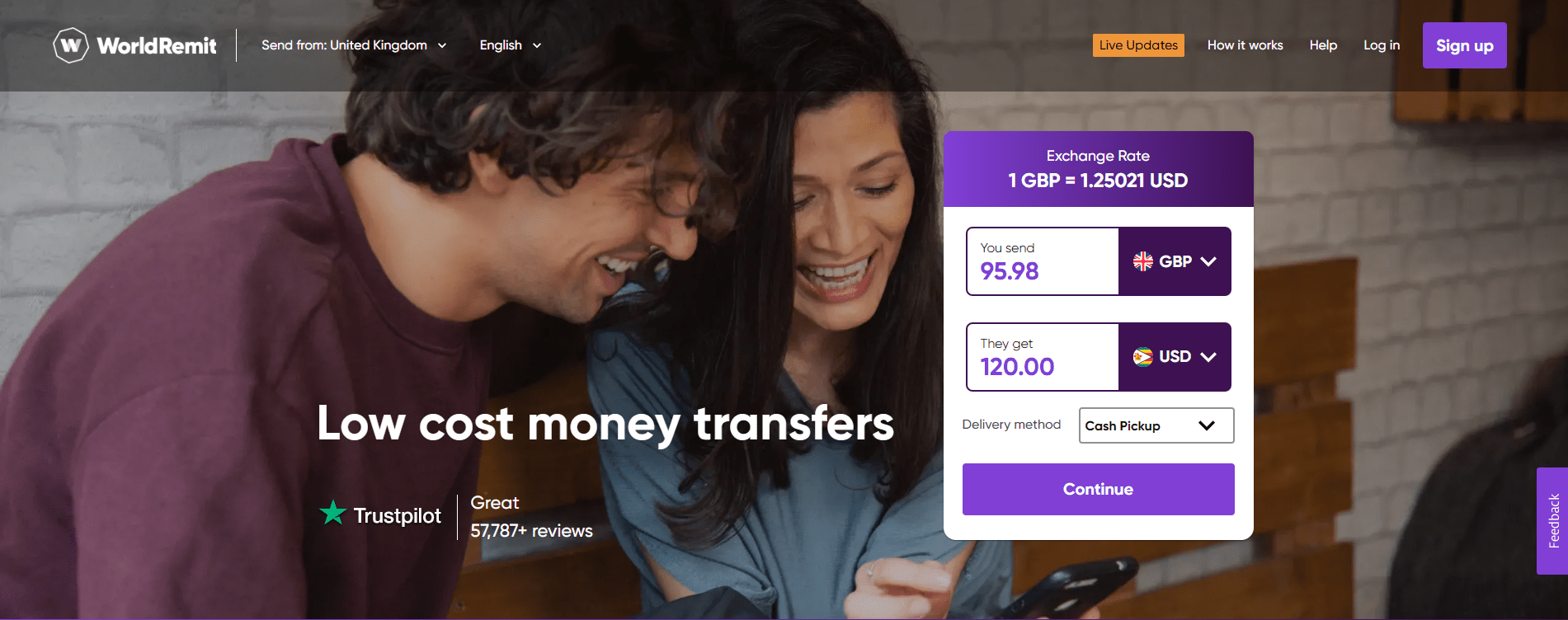

2. WorldRemit — Small amounts in cash

WorldRemit (review) facilitates both personal and business transfers. They provide transfers to over 130 countries via cash, bank transfer, or mobile wallet top-up.

The Best Features:

- Money can be received in a variety of ways (bank transfer, cash pick-up, mobile wallet transfer)

- Contributes to the transport of goods to a diverse variety of countries (130+)

- Rapid – the majority of transfers take less than a minute.

Fees: WorldRemit charges fees based on myriad criteria, including the size of the transfer, the currency combination, and the manner of payout.

However, they do have an attractive bonus offer: When you sign up, you’ll receive three free transfers (with the promo code ‘3FREE’*). Only accessible in the United States of America, the United Kingdom, Australia, Belgium, the Netherlands, South Africa, Sweden, New Zealand, and Norway.

WorldRemit has implemented a flat fee structure for payouts and a tiered exchange rate mechanism (3 tiers). With the flat charge for payouts, your fees remain constant regardless of the amount you transmit (cash, bank transfer, or mobile wallet transfer).

For example, whether you send £100 GBP or £1000 GBP in cash from the United Kingdom to the Philippines, the £2.49 GBP cost will apply. Additionally, the tiered exchange rate ensures that you receive a higher exchange rate the more money you send.

Additionally, keep an eye out for credit card fees and commissions levied by local partners.

Support: Support is available via chat or email. While they offer country-specific phone support, reaching their customer service personnel by phone is difficult.

How does WorldRemit stack up against Wise?

WorldRemit outperforms Wise in terms of supported countries, transaction speed, and payout ways. Although WorldRemit’s rates are better than those offered by banks, Wise remains the more affordable alternative.

Use WorldRemit if:

- You have relatives, workers, contractors, and suppliers located throughout the world and require a transfer provider with a diverse network of recipient nations.

- You want the recipient to get the funds in cash

- You require a speedy transfer of funds (minutes for most transactions)

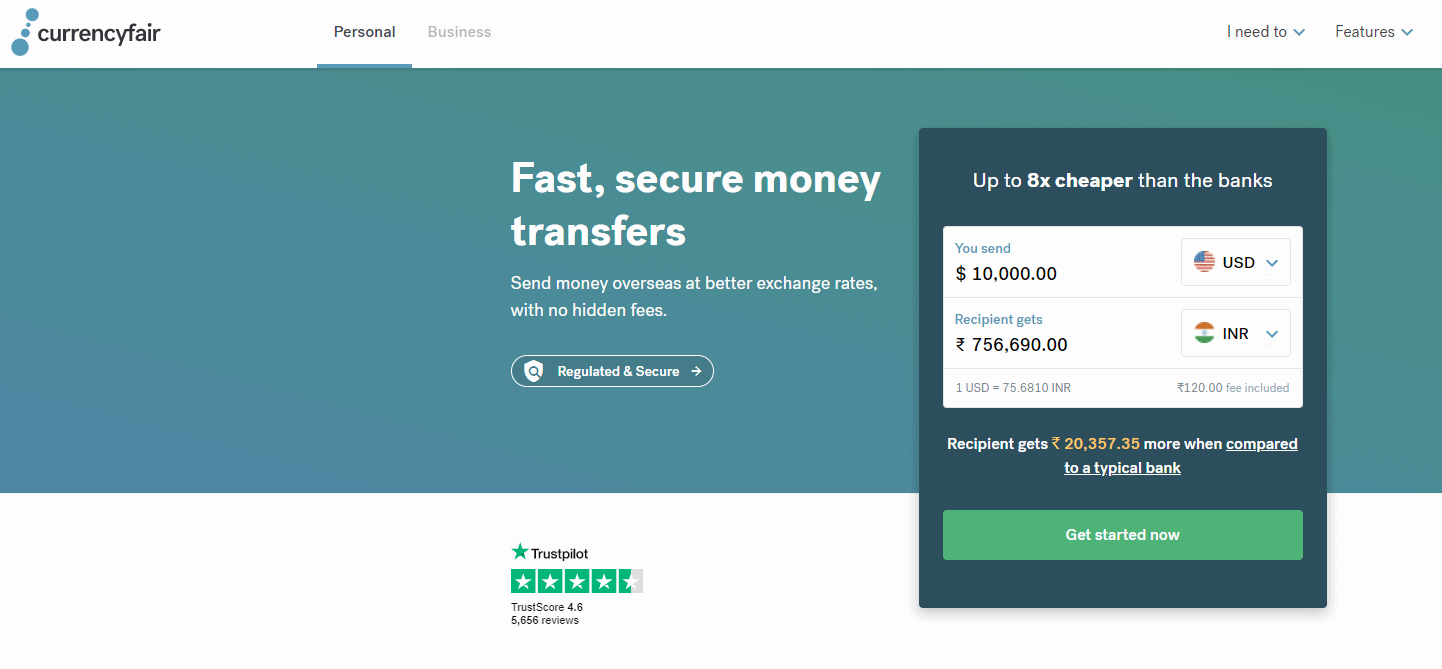

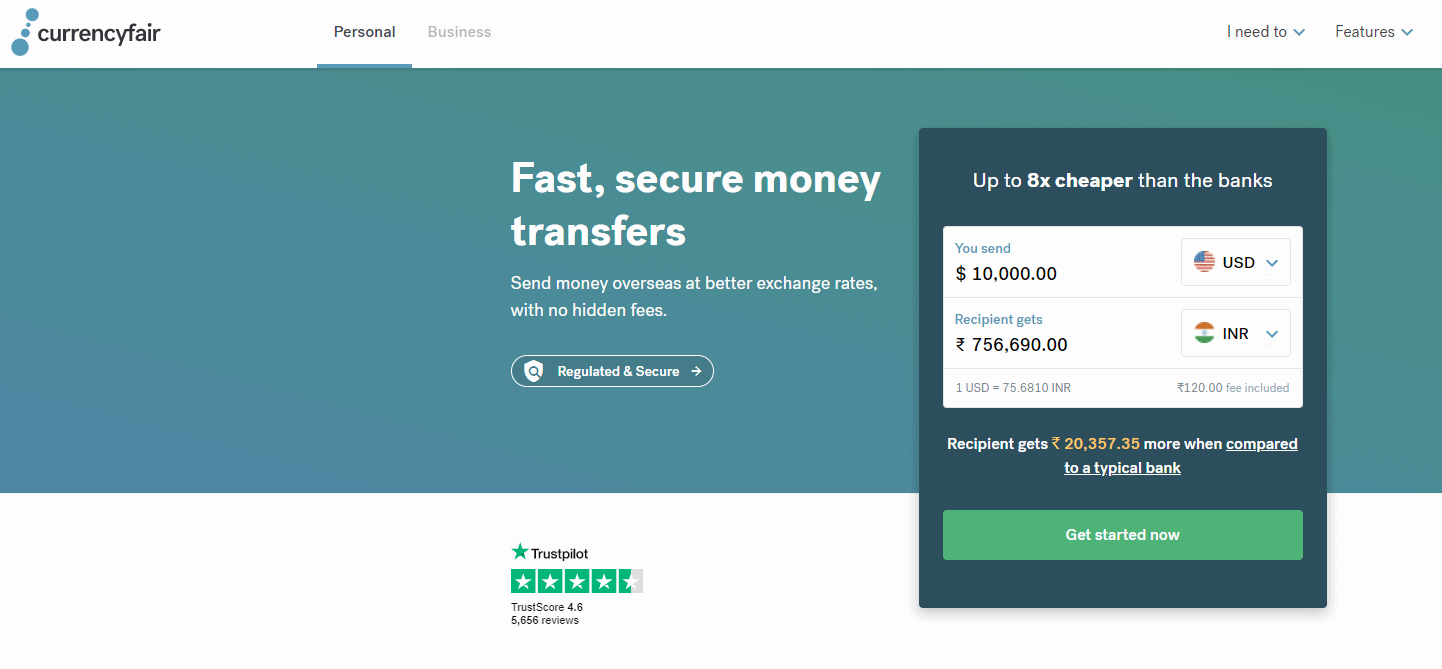

3. CurrencyFair — Lowest Cost

CurrencyFair (review) is one of the most reasonable solutions for international money transfers (in many circumstances, it is even cheaper than Wise!).

How can CurrencyFair maintain such low costs?

The key is in their peer-to-peer (wiki) transfer technique, which connects you with folks who are exchanging currencies in the opposite direction as yours.

However, that is not the finest part: Additionally, you may get your first ten transfers for free here (opens a new tab). Occasionally, currency matching can take some time.

Therefore, if you do not wish to wait, CurrencyFair might intervene and finish the transfer. They accept and send money in 38 different currencies (21 for sending; 17 for receiving).

Features are as follows:

- One of the most advantageous exchange rates

- Choose to exchange at the market rate or on their peer-to-peer marketplace (The CurrencyFair Exchange) – create your own rate and wait for another user to buy your currency at the rate you offer.

Fees: If you use their marketplace to match currency pairs, you will pay a percentage of 0.25 percent to 0.3% as well as a transfer fee of 3 euros (or comparable) and a margin on the exchange rate (this is extremely low).

If CurrencyFair completes the transfer on your behalf, you should anticipate paying between 0.4 percent and 0.6 percent of the total amount, plus a fixed €3 EUR transfer fee (or equivalent), plus a margin on the exchange rate.

In either case, they’re significantly less expensive than banks or Wise (whose fee ranges from 0.35 percent to -1.65 percent ).

Another cost to consider is the receiving bank charges in countries where CurrencyFair does not yet have a local bank account (they do not yet have a local bank account in Canada or New Zealand, which means that receiving CAD and NZD can be relatively expensive for small amounts due to the receiving banks’ fee of typically $15–30).

Support: Email and online conversation

How does CurrencyFair stack up against Wise?

CurrencyFair is one of the few services that regularly outperforms Wise in terms of currency exchange rates. Additionally, their peer-to-peer currency exchange marketplace is a unique feature that enables you to obtain the best rates.

However, there is a significant caveat: you cannot register for their service if you live in the United States. Additionally, there is a possibility of unexpected bank fees if they do not have local bank accounts in the country to where you are sending money.

Apart from that, this is undoubtedly a service worth trying if obtaining the best pricing is a priority.

Use CurrencyFair if:

- You do not reside in the United States

- You’re seeking the best international bank-to-bank transfer rates.

- You wish to send a small sum

- You’re just fine without phone help.

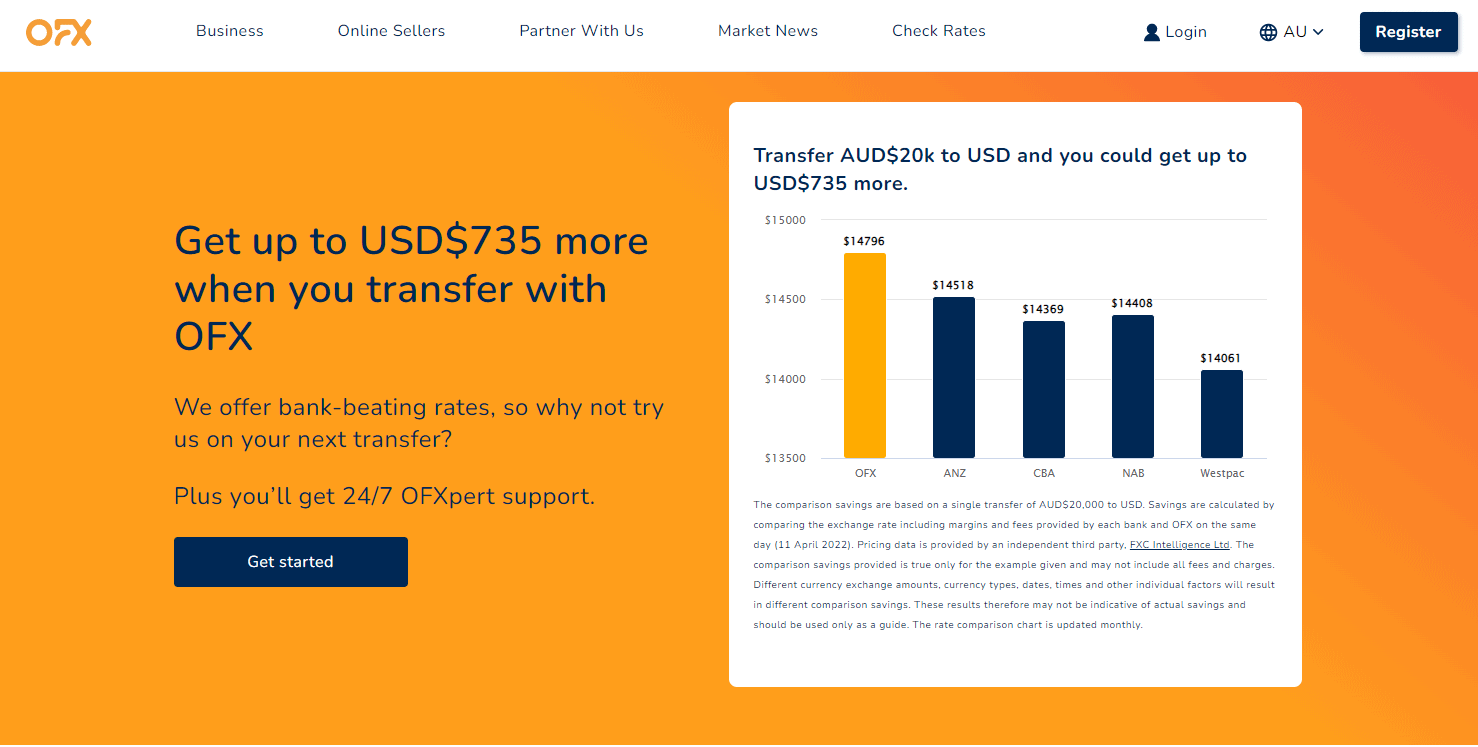

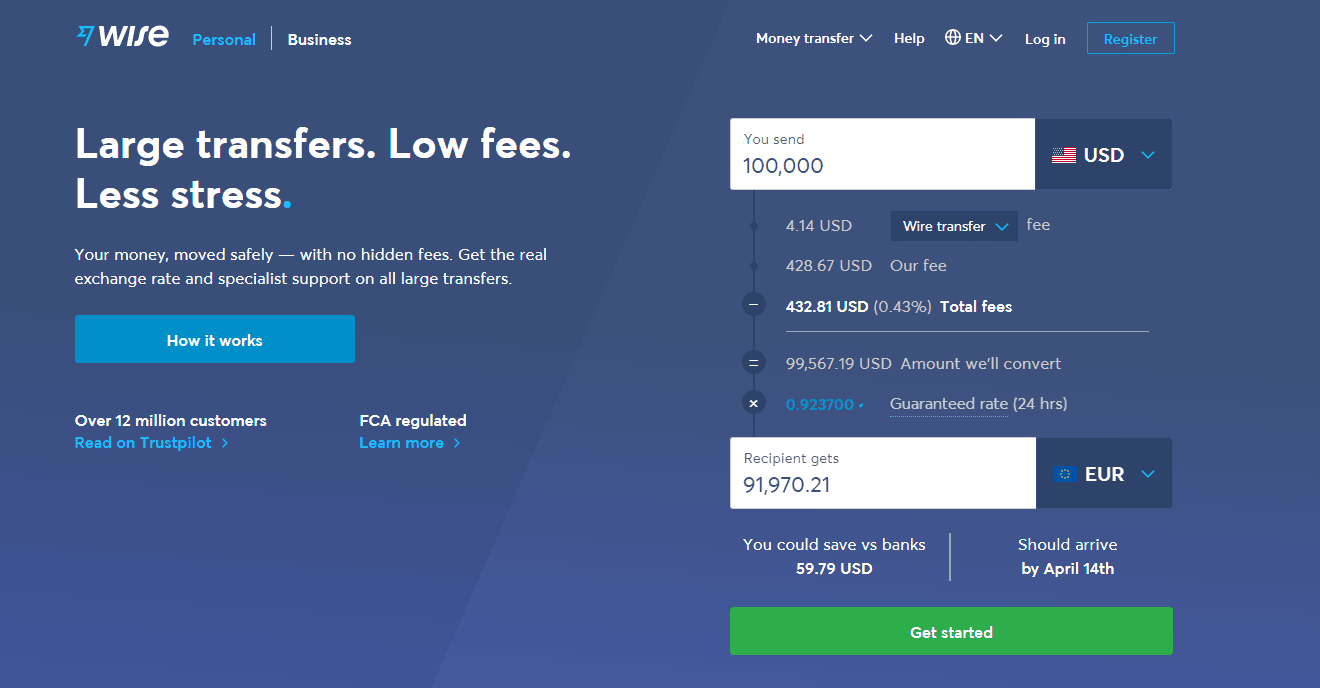

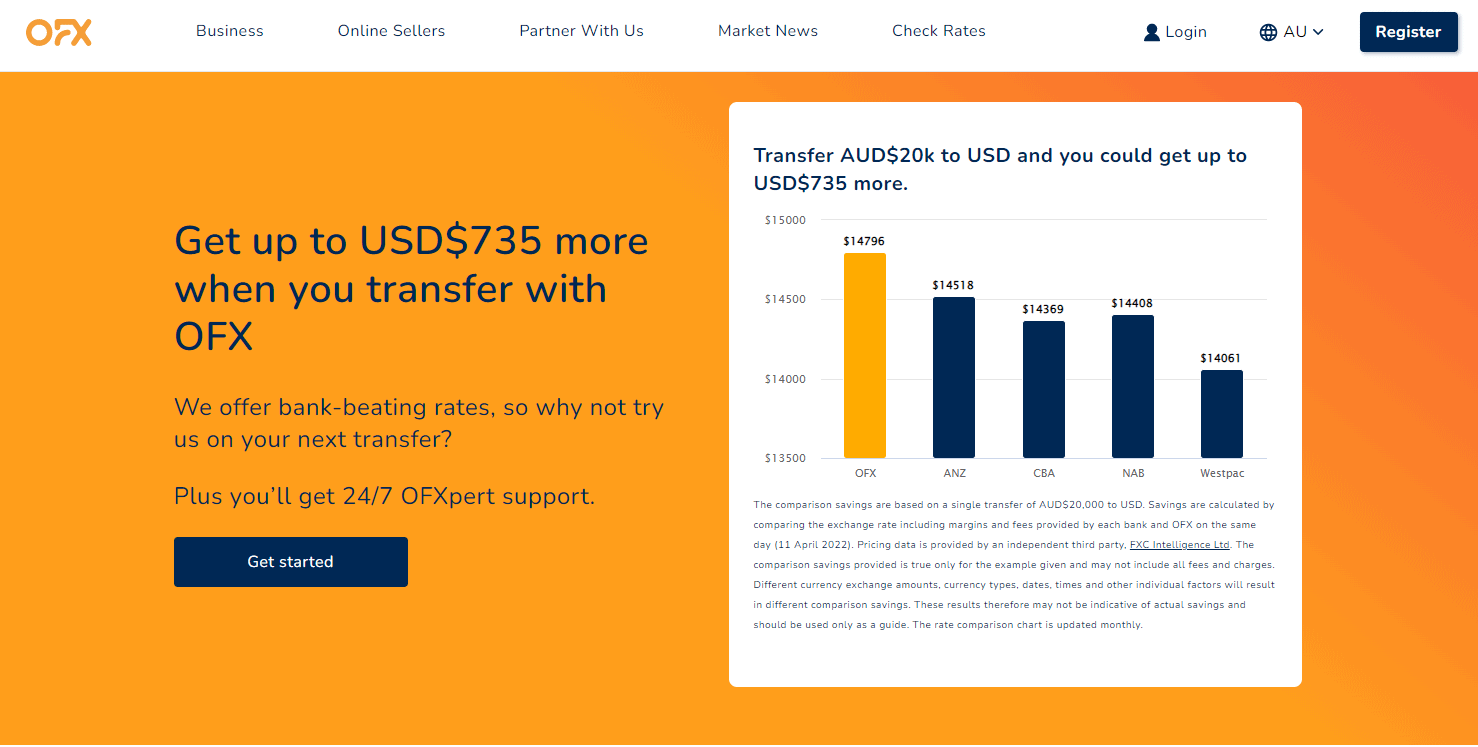

4. OFX – Amounts over $7000 USD

OFX (review) facilitates bank-to-bank transactions in more than 50 currencies in more than 190 countries.

They are one of the most economical international money transfer providers when transferring more than $7000 USD ($7000 USD equals approximately £4000 GBP, €6000 EUR, $9500 AUD, $9500 CAD, $10000 SGD, 800,000 JPY, and 500,000 INR).

Additionally, to keep it reasonable, OFX may charge a flat price of $15, but if you click here, you can avoid this fee in perpetuity! Additionally, they provide 24-hour phone assistance to assist you with issues and setting up your transfers.

Indeed, they make every effort to complete all essential ID and regulatory checks before enrolling in order to avoid bottlenecks during transfers (including larger ones).

Additionally, OFX provides an accessible online platform and mobile application that make it simple to monitor rates, initiate transfers, and trace transfers.

The best aspects include the following:

- 24/7 telephone support

- The online platform that is simple to use

- Rates are guaranteed for up to 12 months.

Fees: OFX was created from the ground up with the goal of making massive transfers inexpensive. For transactions less than $10,000, OFX imposes a flat fee of $15 on the exchange rate in some countries.

Bonus: OFX may charge a flat cost of $15, but by clicking here, you can avoid this fee entirely. However, above that amount, the flat cost is waived and the margin decreases proportionately with the amount.

Occasionally, the receiving bank will charge a fee for your payment. However, you can chat with OFX’s customer service to determine the best way to manage or eliminate this additional fee.

Support: Telephone and email support are available 24 hours a day.

How does OFX stack up against Wise?

OFX is a better option than Wise for sending more than $7000 USD due to its competitive prices and competent phone service. While “helpful telephone support” may not seem significant, it is!

All services, including OFX, Wise, and the banks you use, impose limits after you send moreover around $7,000. This means that each bank has its own restrictions and guidelines regarding the amount of money it will send (usually within certain timeframes).

Transferring significant sums (above $7000) might result in complications occurring throughout the transfer, which, in the absence of excellent phone help, can escalate into a much larger problem. These issues can be fixed quickly and easily with the assistance of skilled phone support.

Use OFX if:

- You’re looking for the best prices on bigger transfers ($7000 USD).

- You reside in the United States of America, Canada, the United Kingdom, Europe, Singapore, Hong Kong, Australia, or New Zealand (where they offer 24-hour local customer assistance).

- You require a high degree of flexibility for large transfers (OFX allows you to lock rates for up to 12 months)

- You require the option of phone help to keep track of your transfer

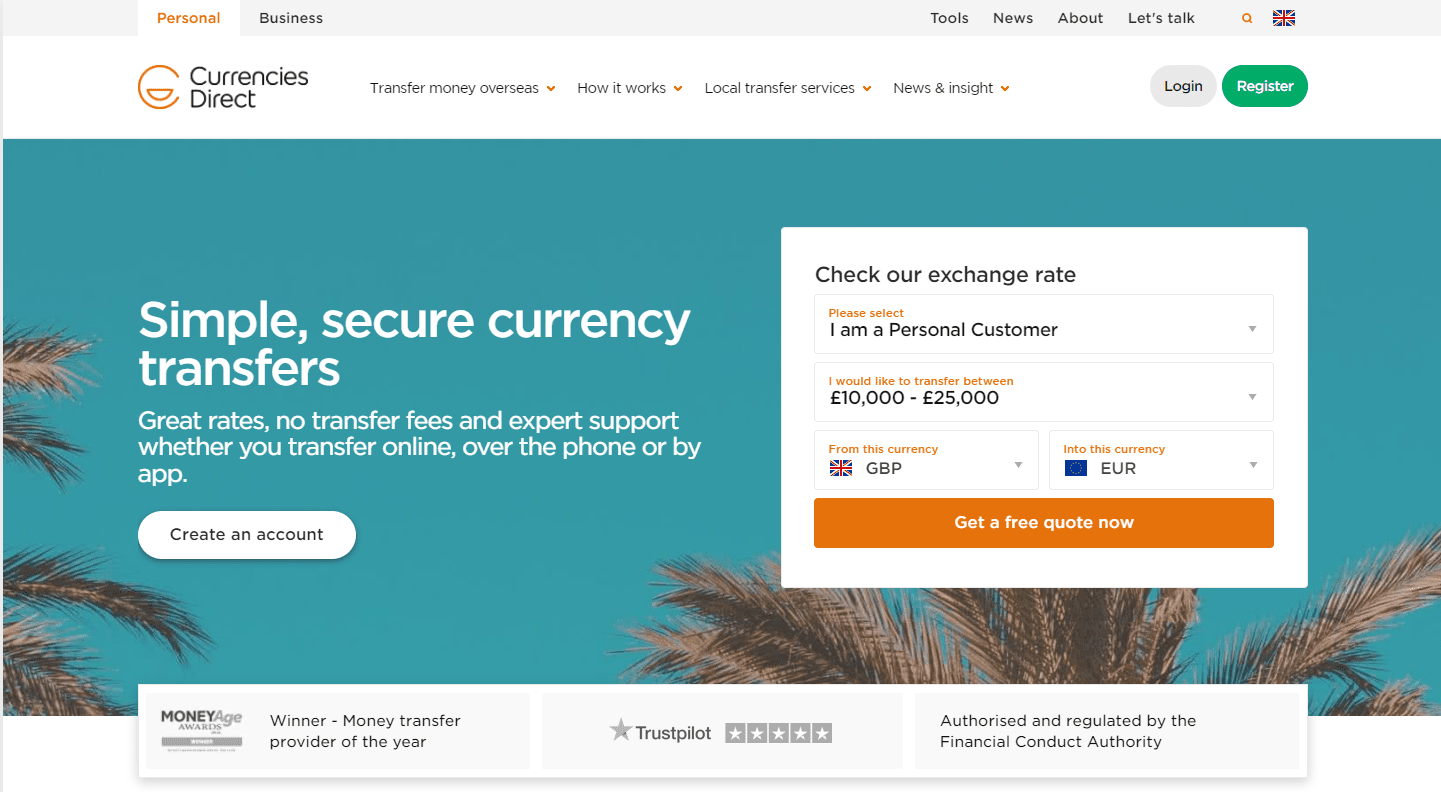

5. Currencies Direct — Personalized Service

Currencies Direct is well-known for its low-cost bulk transfers (above $7000 USD), as they do not charge transfer fees in most cases. They assist both people and corporations with transfers and can assist you in setting up your transfer over the phone.

Additionally, they offer customized solutions based on your unique transfer requirements. Currencies Direct allows you to send up to £25,000 GBP.

The best aspects include the following:

- There are no transfer fees.

- Transferring greater sums of money is simple.

- Additional individualized support via phone and email

- This service is available for both personal and business transfers.

Fees: In most circumstances, Currencies Direct charges simply a margin on the exchange rate and does not collect any further fees. If there is a price, they inform you in advance. However, fees may be charged by receiving banks or intermediaries.

Support: Telephone and email support

Currencies Direct vs. Wise: How does it compare?

From the start, it’s evident that Currencies Direct is going after a different market than Wise. Currencies Direct is oriented at enterprises and large-value personal remittances, whilst Wise is geared toward smaller-value personal payments.

As a result, their service is more personalized. Unlike Wise, you cannot obtain a quick estimate of the cost of transferring your money. You must enter your information on their website and someone will contact you directly.

This may appear to be inconvenient. However, if you’re dealing with larger sums, it’s far better to contact a knowledgeable professional who can walk you through the procedure.

Additionally, they do not support as many currencies as Wise does (40 in total). As a result, this may be a disadvantage for some.

Use Currencies Direct if:

- You wish to send significant bank transactions – You reside in the United Kingdom, Canada (except Quebec), the United States of America, Spain, Portugal, South Africa, or India, where they maintain physical offices (For transferring large amounts, I recommend going with a provided who has a physical presence in your country)

- You desire access to currency products such as spot or forward contracts;

- You value personalized service from your international money transfer provider.

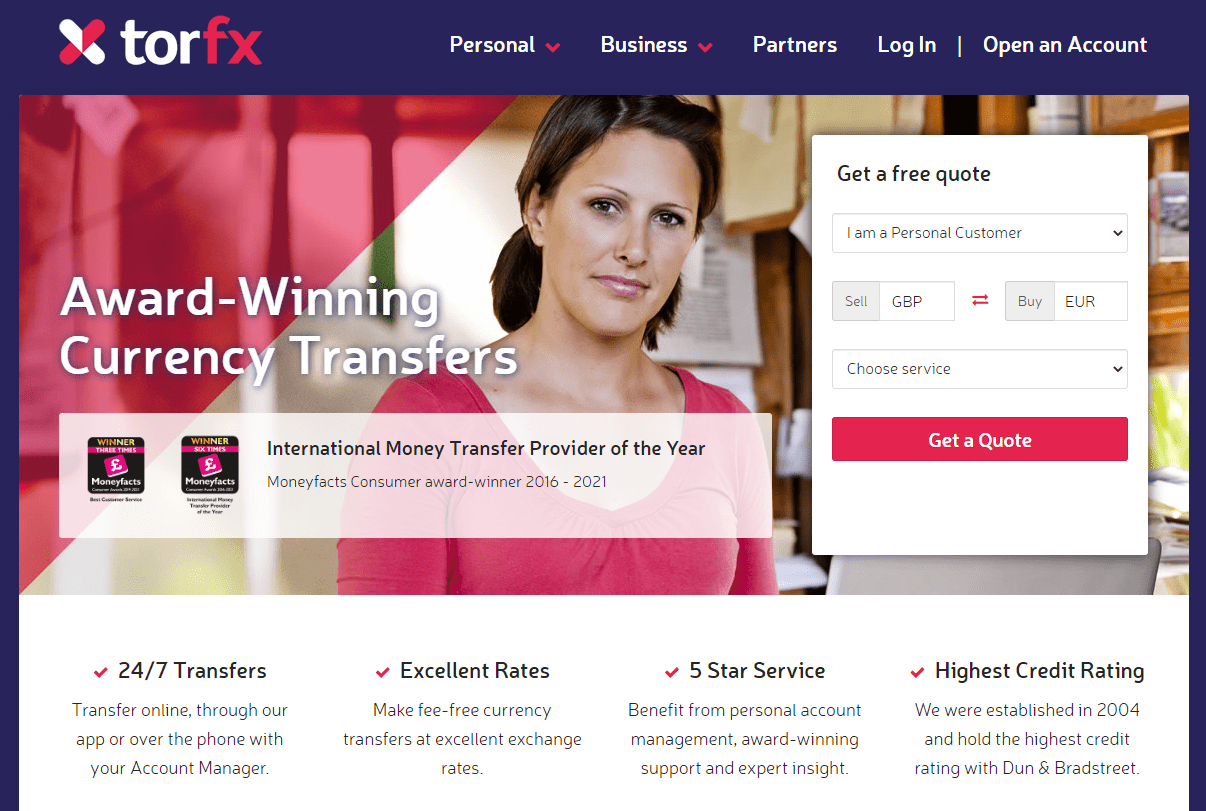

6. TorFX — Recommended for personal account manager

TorFX is actually a subsidiary of the same company that owns Currencies Direct. As a result, it has one of the best customer bases in the money transfer industry.

As a result, they are one of the most dependable (and frankly, reassuring) providers for sending large amounts (above $7000 USD) internationally. Indeed, they are pleased to speak with you on the phone to assist you with the signup process and when you need to schedule a transfer.

The Best Characteristics:

- Easily manages big transfer amounts

- Individualized service is provided by a personal account manager.

- Telephone assistance

- There are no transfer fees.

Fees: TorFX does not charge any fixed fees; rather, it charges a margin on the exchange rate (mid-market rate). As a result, they are extremely inexpensive for bulk transfers.

However, banks on both ends may levy costs, so it’s a good idea to inquire about typical expenses for significant amounts with the receiving bank.

Support: Telephone and email support

How does TorFX stack up against Wise?

TorFX is another service on our list that distinguishes itself from Wise by focusing on higher transfer amounts.

What makes TorFX unique is that you’ll receive a personal account manager to assist you during your transaction – critical when dealing with large sums and need to connect readily with the transfer service.

Additionally, they support a respectable amount of currencies (40+), but not quite as many as Wise. Additionally, TorFX is not available in the United States of America or Canada (their sister brand, Currencies Direct, handles that region). TorFX’s primary markets are Australia and Europe.

Use TorFX if:

- You are a resident of Australia, New Zealand, Asia, the United Kingdom, or Europe and wish to send money internationally (TorFX has offices in the United Kingdom, Singapore, and Australia).

- You wish to send a huge sum

- You value personalized service and would like to be guided through the process by a personal account manager and phone assistance

- You’re not interested in paying transfer fees.

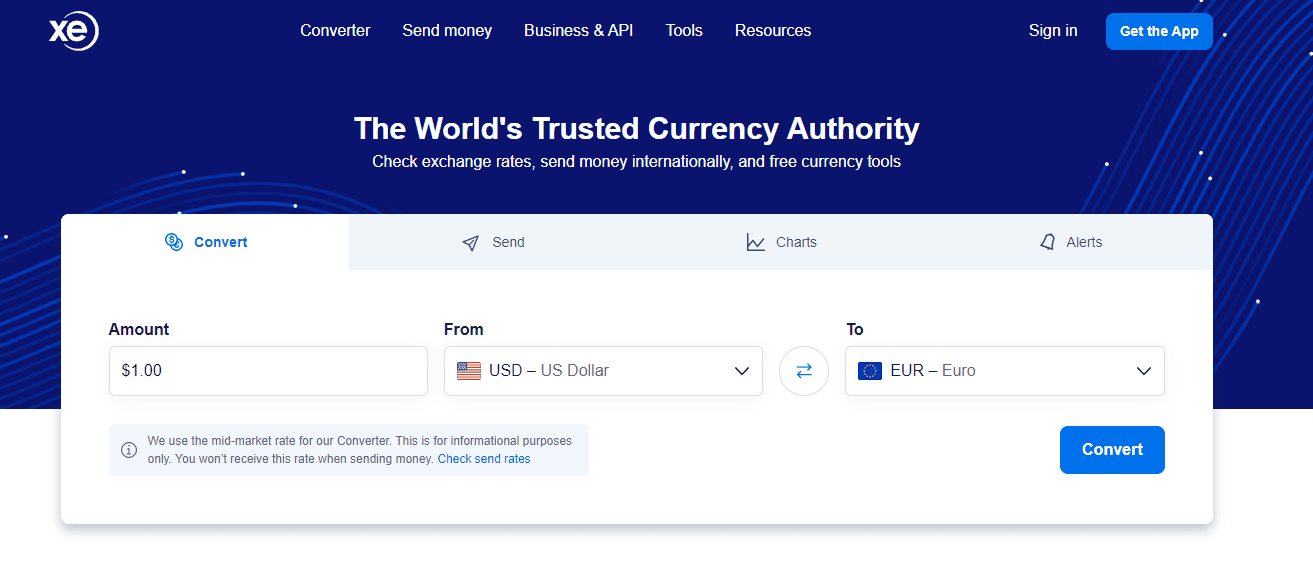

7. XE – English, Spanish, and French telephone support

XE (review) allows you to send up to $500,000 USD or equivalent and supports transfers in 98+ currencies to over 130 destinations. They are a highly regarded provider of services for massive bank-to-bank transfers.

The best aspects include the following:

- Supports a diverse array of currencies

- Support in several languages through phone

Fees: For transactions less than $7000 USD, XE charges flat fees and a margin on the exchange rate. Typically, they do not charge a flat cost for large transactions and instead make them cheaper by decreasing the margin as the amount transferred increases.

Support: Phone Comparison

How does XE stack up against Wise?

As is the case with Wise, XE is heavily focused on internet transactions. As a result, this is the greatest option for people looking to do quick internet transfers without the assistance of a salesperson.

And, while Wise accepts transfers of all quantities, we’ve found that its rates for smaller transactions are consistently lower than those offered by XE. The two areas in which it outperforms Wise are the number of currencies supported and the prices for larger transfers (XE does not charge a fee for larger transfers).

They are, however, less clear about prices than Wise, as banks on both sides may still impose their own fees when transferring via XE.

Use XE if:

- You are comfortable transferring huge sums of money online

- You live in the United States of America, Canada, the United Kingdom, Europe, Australia, or New Zealand (all of which have customer service teams)

- You’re looking for a variety of acceptable receiving currencies.

- You require multilingual customer service for your transfers (although XE is mostly online-focused)

Quick Links:

Conclusion: Best Wise Alternatives 2026

Wise (previously TransferWise) is a fantastic service for the vast majority of individuals. That is why I named it the best money transfer service for amounts less than $7000 USD. However, money transfer involves numerous moving components.

The primary reasons you might want to use another service instead of Wise usually boil down to the following: Greater sums (above $7000 USD). I discovered that OFX was built from the ground up to handle enormous volumes.

This implies that registration can be more involved (but is less likely to cause problems later), and they offer both online and phone help (which is expensive for them to run, but can be vital for your larger transfers).

To top it off, their fees are quite competitive, as their percentage-based rates decrease as the amount is increased. However, you may have additional priorities. (Perhaps you require cash collection for the receiver? Or the service you’re interested in does not support your currency.)

The reality is that in many instances, it makes sense to utilize multiple services. Therefore, take your time shopping and choose a few that you can call upon depending on the situation.