We’ve covered PocketSmith alternatives in this article; are you ready to move on from PocketSmith? Is PocketSmith not syncing with some of your accounts anymore?

If this is the case, we will discuss some of the best PocketSmith alternatives as well as why you should think about the hassle of switching to another budgeting and money management software.

PocketSmith was a fantastic personal finance tool, but competitors have surpassed it. You can also check the latest pocketsmith coupon & discounts for the latest offers.

Content Outline

Best PocketSmith Alternatives

1. Personal Capital

Personal Capital is my personal favorite of the PocketSmith alternatives. It’s web-based, focuses on investing but also tracks expenses and budgets, and, best of all, it’s free.

The short version is that Personal Capital has a suite of investing-related tools that Mint does not.

I was less interested in the expense tracking features and more interested in getting a better handle on where my investments were and whether I was doing it correctly, and Mint was no longer cutting it.

I get the impression that you’re looking backward with Mint. If that makes sense. With PC, I feel like I have a better idea of where I’m going.

Personal Capital, like PocketSmith and many of the alternatives on this page, is free. It’s free because it provides wealth management services, similar to Betterment, rather than because it’s subsidized by advertising. If you’re tired of seeing advertisements for new credit cards and other financial products, you’ll be relieved to know that Personal Capital doesn’t have any.

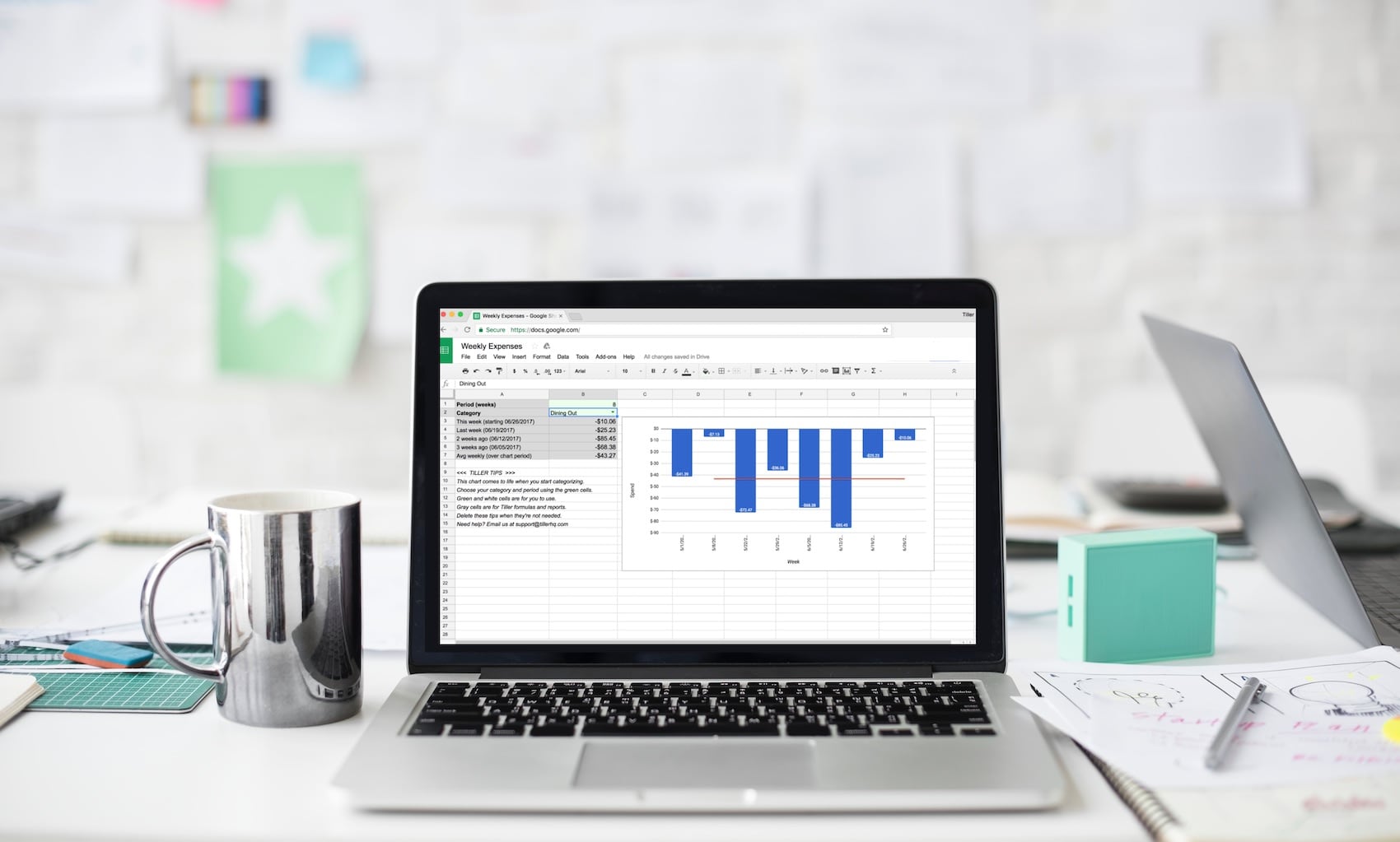

2. Tiller

Tiller is the only option on the list that will allow you to take everything in-house and track your money with a spreadsheet. Tiller allows you to enter your budget into a spreadsheet and they will pull your transaction data from your financial institutions.

It is the only service that will sync your financial transactions into a completely customizable spreadsheet. It was founded in 2015. (they support Microsoft Excel and Google Sheets).

It’s only $6.58 per month (billed at $79 per year), but you get access to a plethora of templates to help you get started with your spreadsheet if you don’t already have one.

3. You Need a Budget

PocketSmith is a powerful budgeting app, but if you want to really get a handle on your finances, you must look forward rather than back. You Need a Budget, or YNAB is an excellent budgeting tool because it is based on zero-based budgeting and projects your budget forward.

YNAB focuses on four rules – Give Every Dollar a Job (zero-based budgeting), Embrace Your True Expenses, Roll With The Punches, and Age Your Money – that help you take what you’re doing now and put it in a framework that will set you up for future financial and budgeting success.

Whereas Mint is about tracking and trying to stay on track, YNAB is about planning ahead of time and allocating your next paycheck – a subtle distinction that has helped many people change their financial future. After a 34-day free trial, YNAB charges a monthly fee of $14.99 (or $98.99 if paid annually).

4. LunchMoney

LunchMoney is a cute budgeting and net worth tracker designed as a lighter alternative to Mint. It essentially does everything Mint does, but without the advertisements. Transactions can be split, grouped, tagged, and classified. To learn more about your spending, you can track your net worth, create a budget, and even run analytics on your transactions. You can import all of your transactions or manually import them if you don’t want to enter your banking information.

One nice feature is that it is a one-person operation with excellent customer service because she responds to emails within a day. Her blog states that she is currently residing in Taiwan, so the time zone will be different.

They also have a developer API, which allows you to build things using data from your account. Nobody else provides this.

LunchMoney, on the other hand, is not free; it costs $8 per month or $80 per year ($6.67/month). It’s a small price to pay to avoid all of Mint’s ad clutter! They offer a 14-day trial period that does not require a credit card to begin.

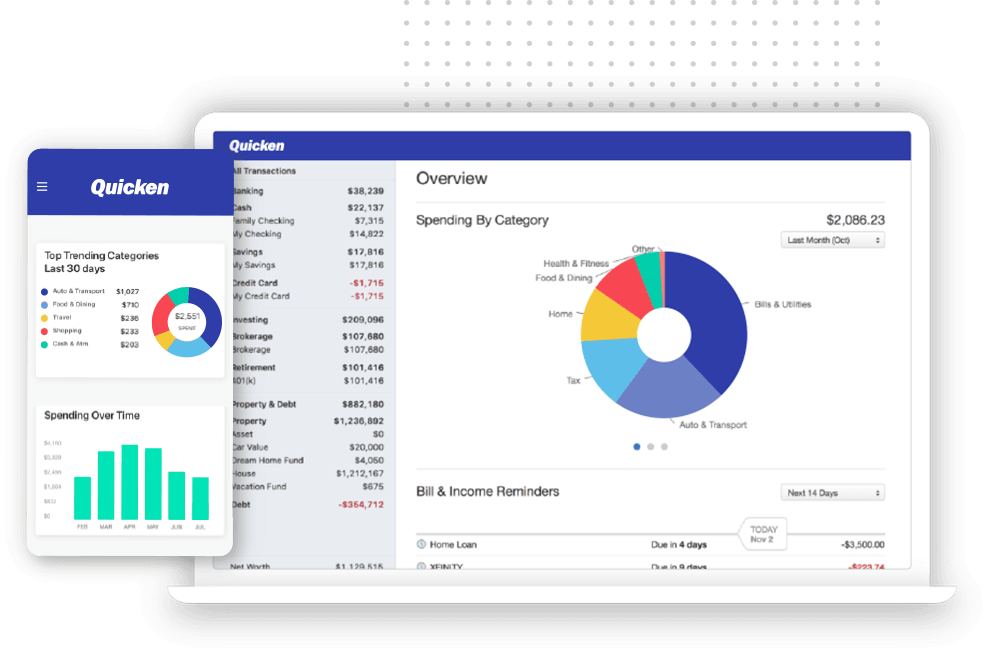

5. Quicken

If the thought of putting your data in the cloud worries you, and you thought Quicken might be the solution, I have bad news: Quicken now puts your data in the cloud as well. But, like everyone else, they have bank-level security, so it shouldn’t be a problem.

Quicken does offer something that these other services do not, and that is the ability to set up bill pay, which works well for some of the smaller banks that do not offer it, though it does come with a fee. It also retrieves your home’s value from Zillow, if that is important to you.

Quicken is a software application that you buy (starting at around $30 for the Starter Edition but quickly rising) and install on your computer (or mobile device).

Conclusion: Top 5 Best PocketSmith Alternatives In 2026

It all depends on what you require. PocketSmith is still the best option for simple budgeting with no frills.

If you want more features, such as investment tracking or financial planning, you’ll need to upgrade to Personal Capital.

If you need assistance creating and adhering to a budget, a service like You Need a Budget will be more effective in changing your spending habits.