Are you thinking about stepping into the stock market or already in it and looking for a game-changer?

Then you’ve probably heard about Finviz(Finance Visualization). This tool is like a treasure map for investors and traders.

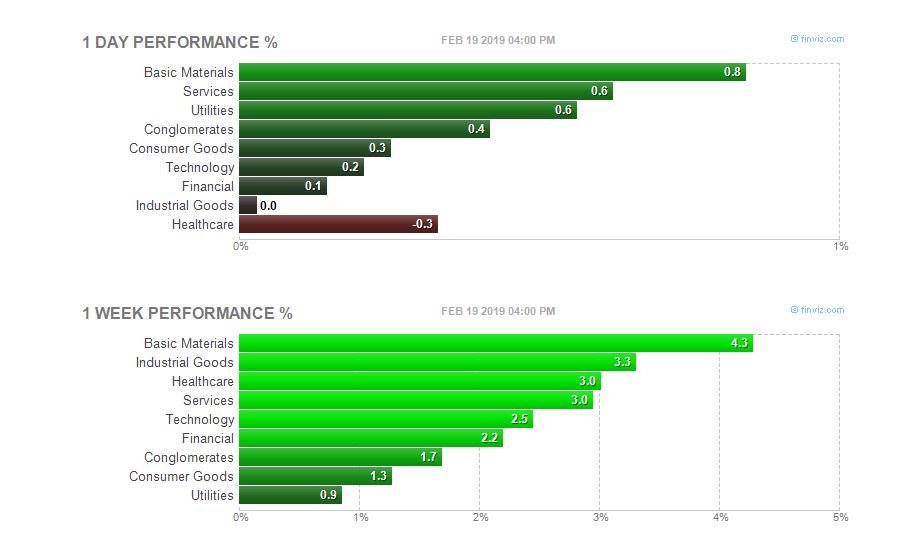

Finviz shows you everything from stock prices and patterns to in-depth analysis, making it easier to make smart decisions.

Whether you’re a beginner or a seasoned trader, Finviz has something for you.

In this review, I’m going to share my experience with Finviz, highlighting how it helped me see the stock market in a whole new way. From its easy-to-use features to its powerful insights, let’s explore why Finviz might be the tool you need to level up your trading game!

What Is FINVIZ.com – Stock Screener? Finviz Review

Finviz is a commercial and inventory control tool for creating financial visualizations.

This is one of the many stock market research websites that professional traders use to save time. It allows traders and investors to find the stocks they seek quickly.

Finviz stock screener includes tools for stock traders to see what happens in the stock market. The tool includes an entire screen with a selection of values to search for actions that match specific parameters and a detail page for each action.

The site offers free access without registering so that you can start the market analysis immediately.

Finviz stock screener is a stock market research platform that aims to provide powerful technical studies and fundamental tools to investors and traders.

Its main objective is to provide traders with superior financial analysis, visualization, and research.

Why Should You Try Finviz?

FinViz Stock Screener Features:

Here, Finviz differs from the competition and offers the greatest benefit as stock analysis software. It’s incredibly flexible, easy to use, and versatile in free mode.

The platform allows traders and investors to enter various criteria and receive each action according to their criteria.

You can search for stocks, price, beta, specific candle type, market cap, RSI, average volume, floating shorts, sector, or even outstanding shares. The list will continue based on your investment style.

With the scanner, you have complete control over all your scans. The best you can do is save your favorite scans for later use. With this feature, traders can spend countless hours analyzing graphics manually.

In this respect, it is considered a very effective tool for investors who want to buy and sell stocks at optimal times.

Finviz Pricing Plans: How Much Does Finviz Cost? 💸

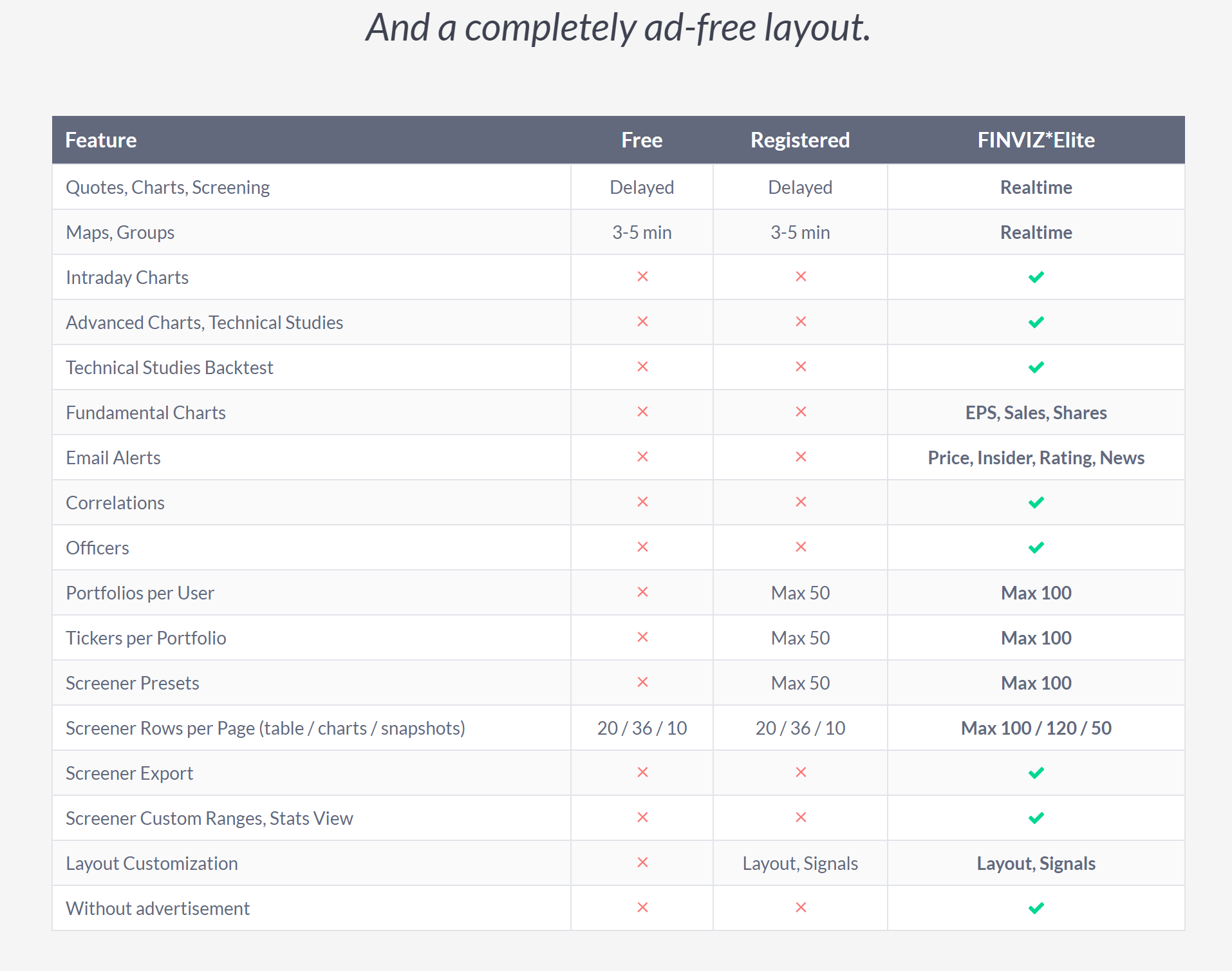

Everyone can access Finviz for free. However, there are three types of membership: free, registered, and elite.

The plan for free access includes delayed cards and groups of 3 to 5 minutes, as well as projections, appointments, and delayed graphics.

Also apply the Finviz elite discount codes and coupons to get the best price.

The saved plan, on the other hand, requires the user to register for free access.

This plan includes free access to daily advanced charts, up to 50 screener preset selections, limited selection results, portfolio bookmarks, and all other free access features.

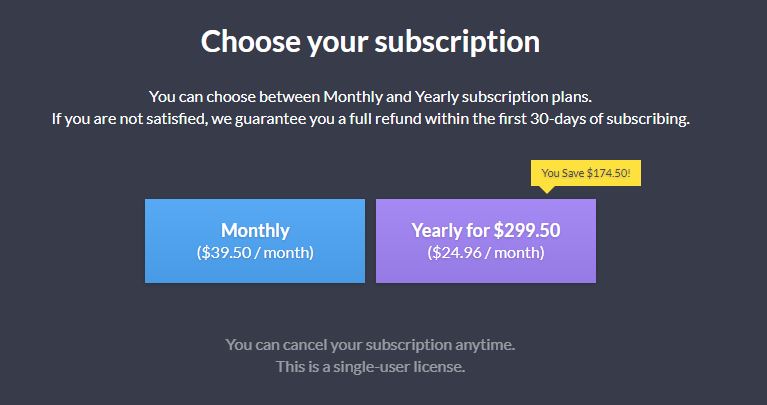

Finally, we have the Finviz Elite Plan, which costs $ 39.50 for a monthly subscription and $ 299.50 for an annual subscription. However, users can save up to $ 100 by choosing a yearly subscription.

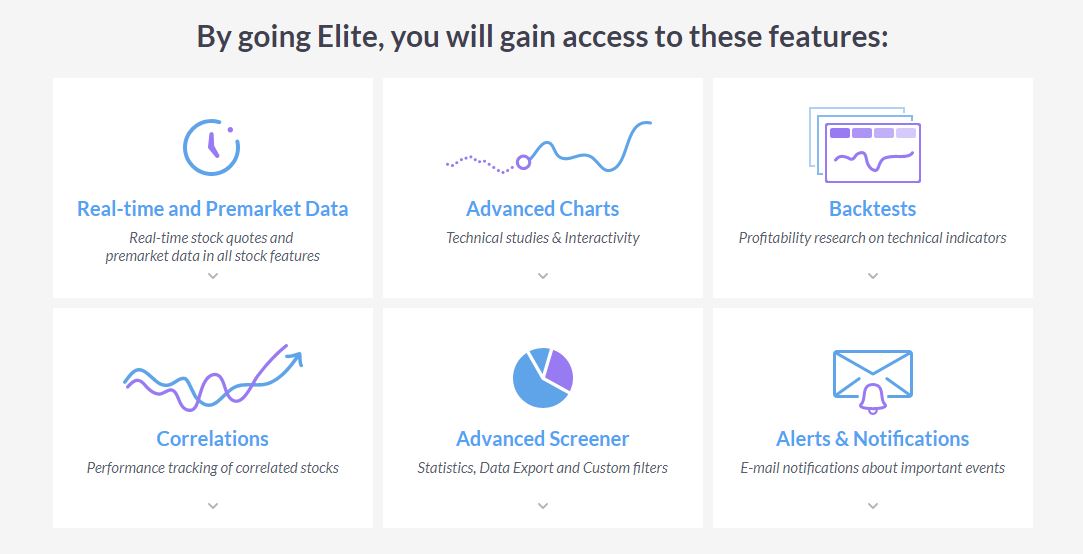

As a premium service, it offers advanced charts, background tests, maps, and groups in real-time, news email alerts, prices, rankings, and insider information, up to 100 screen presets, predefined filter settings, correlations, and screen export.

In addition, users can benefit from basic charts, real-time filters, schedules and charts, intraday charts, engineering studies, up to 100 portfolios, and tickers per portfolio – all without advertising.

Pros And Cons

| ✔️ Pros | ✖️ Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Why is Finviz a better stock research platform?

It’s free, but they also provide a first-class service.

Free users typically have access to features such as filtering, schedules, and graphics. In contrast, Premium users can access the graphics of the day without interrupting announcements, real-time data, alerts, and basic information.

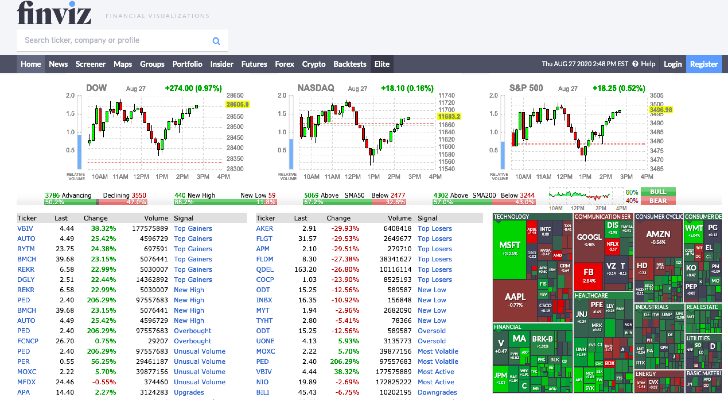

In addition, its intuitive interface provides a complete overview of the market’s all-in-one platform.

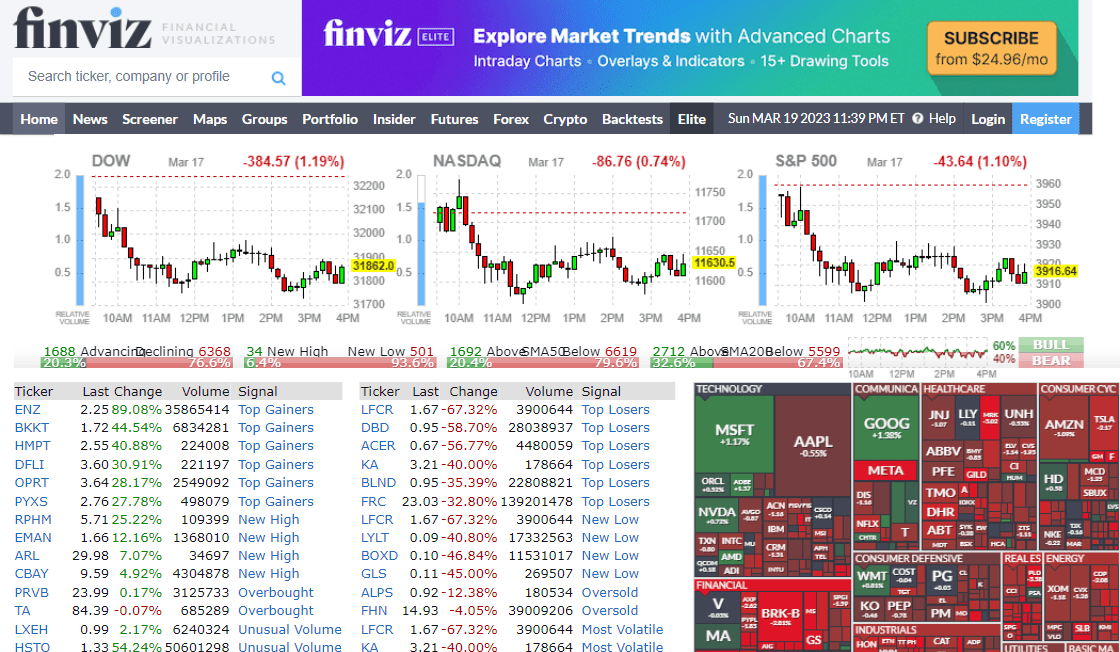

The home page provides an overview of the global stock market indices displayed with Japanese candlestick charts.

This guarantees operators a quick overview of the condition and performance of the entire market. As you scroll through the page, you’ll find plenty of information, such as insider information, earnings pamphlets, and actions with important information.

Therefore, the amount of information this screener tool provides can be huge.

What Types Of Traders And Investors Use Finviz?

The Finviz stock screener is helpful for both professional traders and investors.

Traders use it to find stocks likely to experience higher price moves in the coming days or weeks.

Sometimes, stocks are in the headlines, and sometimes, stocks increase in volume or volatility.

As head of stock selection, Finviz is the most valuable stock trader and stock index trader.

Although much more valuable to individual stock traders, it will be helpful to those who trade index futures, options, and ETFs, as they can see what determines the index’s price level.

- Day operators use Finviz to find actions that other day operators focus on.

- Swing operators can use the Finviz application to find oversold or overbought stocks traded in a well-defined channel. Therefore, the stock market scanner is ideal for recognizing new business ideas.

- Momentum operators can find holdings that have performed best over a predetermined period.

- Technical traders can use the stock search tool to search for actions that exceed averages or configure traditional graphics models. This is especially useful for beginners to save time in technical analysis.

Investors use Finviz to find stocks that meet specific fundamental characteristics. Investors can also use the site to combine technical and fundamental criteria or program their inputs and outputs with the price action.

The Finviz pocket scanner is suitable for different investor types.

- Value investors can identify value stocks based on price-earnings ratios, price-book ratios, and other similar valuation metrics. In this way, value investors can easily find undervalued stocks.

- Growing investors can use the stock scanner to look for high-growth stocks or stocks recently updated by analysts.

- Current investors can use the stock price to identify moving stocks and technical filters for quality, earnings growth, or value. This can be helpful for investors to find new business ideas.

- Investors who prefer small companies can use Finviz as a selection tool for listed stocks when filtering by market cap. You can use the stock scanner to find the best penny stocks.

- Dividend investors can find stocks with high dividend yields and filter a list to eliminate low-quality stocks. This is ideal for investors who want to build a passive income portfolio.

Different types of investors can use the Finviz Exchange Scanner to search for stocks that match their investment strategy.

As a result of this review by Finviz, we will discuss several criteria that could help investors identify investment measures.

Some factors that investors may consider in research are:

- Market capitalization: Value-oriented and growth-oriented investors are often aimed at small companies that can achieve higher percentage profits.

- Top Insider Trading: Executive transactions can give investors a good idea of what people near the company think about their prospects.

- ROI (return on investment): A return of more than 15% is a good sign that a company has healthy margins and a healthy financial position.

- Rating: There is no perfect rating. However, the price/price, the price/book value, and the selling price give the investors a good idea of the purchase price of a security compared to other securities.

- Price / Free Cash Flow: Comparing the stock price with the free cash flow can give you an idea of the reasonable price of an action in terms of actual cash flow generated. It is an excellent tool to compare companies in the same industry.

- Forward PE: The PE advance compares the price with the analyst’s average earnings forecast for the next 12 months. If the EPS of futures of action is lower than the current PE, the stock will likely gain.

Short-term operators use filters such. For example, Stock to find in-game inventory. Traders, hedge funds, and institutional fund managers increasingly respect these values.

They may be at stake because of the company’s activity, the publication of results, the announcement of products, or when they have exceeded a significant technical level.

Some parameters Considered By Short-Term Traders:📈

1. Results Date: With Finviz, you can search for stocks that have published earnings data in recent days, weeks, or months or companies that need to post data in the following days or weeks.

2. Relative volume: When shares are involved, the average trading volume is usually higher than usual. The relative volume setting allows you to search for actions between 1.5 and 10 times the average volume.

3. Drifting in the short term: If many operators hold short positions in security, short-term pressures often lead to a significant return to safety. Traders generally monitor stocks when short positions have more than fifteen percent of outstanding shares.

4. Moving Average Exceeded: Short-term traders can see stocks that have exceeded their moving averages at 20 and 50 days. An average mobile cross may indicate that a plot undergoes a trend change in the short to medium term and is accompanied by greater acceleration.

5. Schemes: Finviz can warn traders of traditional graphical advanced charts made by the price of action. Once the dealer has identified the model, a price alert indicates that the price exceeds the model.

6. Moving Average Exceeded: Long-term traders usually look for stocks that exceed the 200-day moving average and monitor the stocks to confirm the new trend.

This review of Finviz would not be complete without advice for traders considering longer delivery times.

Long-term traders deal mainly with trends and major graphic trends:

FAQs About Finviz

❓Is Finviz accessible without registration, and how can I start market analysis immediately?

Yes, Finviz offers free access without the need for registration. Users can initiate market analysis immediately by visiting the site and utilizing its stock screener tools.

👀What is the main objective of Finviz's stock market research platform?

Finviz aims to provide powerful technical studies and fundamental tools to investors and traders. Its primary objective is to offer a platform for superior financial analysis, visualization, and research.

✅Is Finviz suitable for both professional and beginner traders?

Yes, Finviz is designed for both professional and beginner traders, offering ease of use, a user-friendly interface, and customizable features to cater to various skill levels.

😶Does Finviz offer special offers and discounts for forex traders?

Finviz provides a platform where traders and investors can set various criteria to filter stocks based on their preferences. This includes criteria such as price, beta, specific candle type, market cap, RSI, average volume, floating shorts, sector, and outstanding shares, offering a personalized and comprehensive stock search experience.

Quick Links:

Conclusion: Is Finviz Worth It?

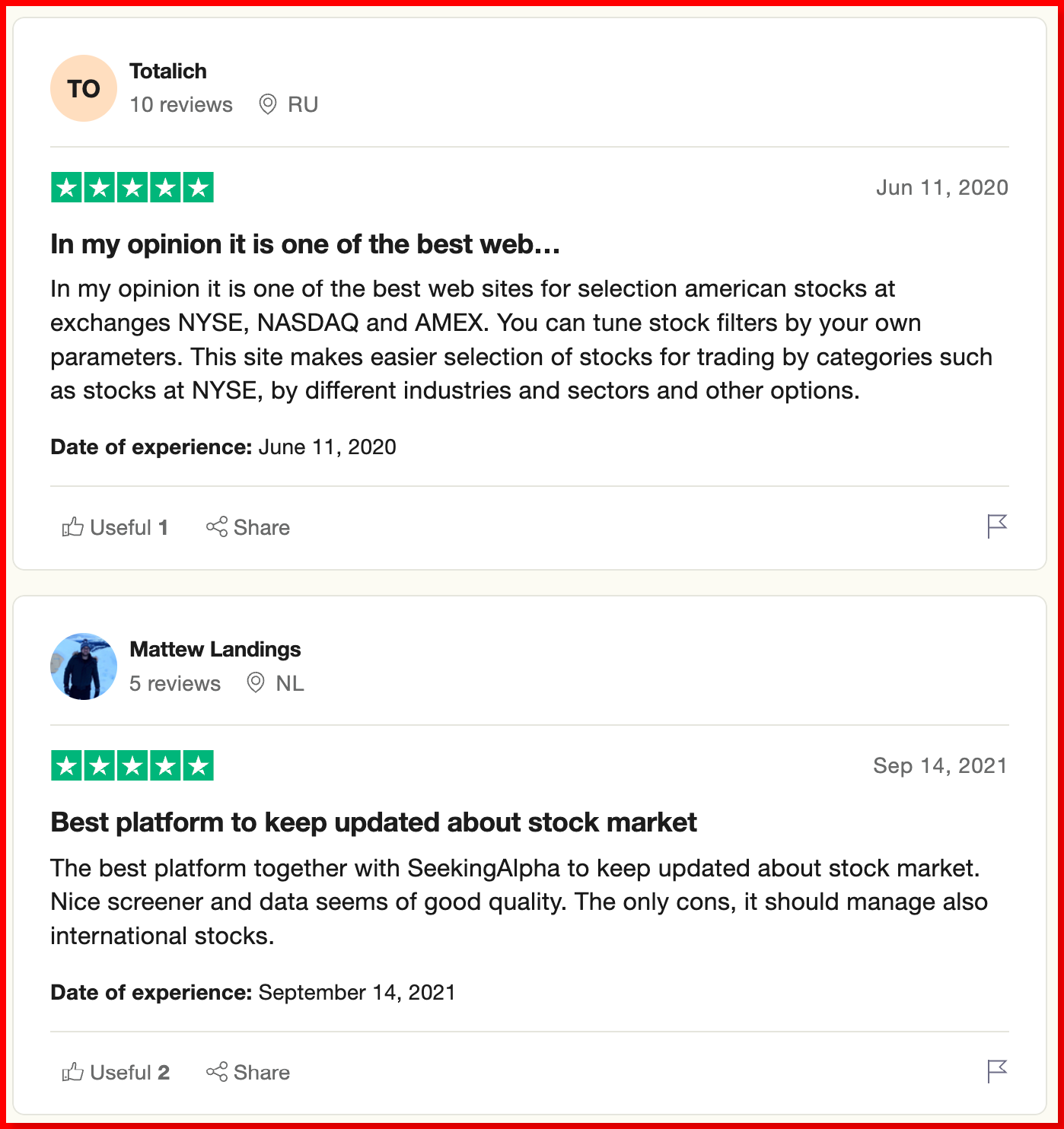

Yes, Finviz is worth it. The fact that there is a free plan and a free registered plan makes it an excellent platform for new operators unwilling to spend their hard-earned money.

However, being free means that their features are limited compared to the premium service, Finviz Elite.

If you want to access high-quality inventory control tools at an unbeatable price at the end of the day, be sure to try the Finviz discount.

If unsatisfied, you can still get your money back and cancel your subscription. A monthly subscription costs only $39.50, and $299.50 for an annual subscription.

Is Finviz the best stock sorter? It depends on your investment style, but most agree it is one of the best.

The free version includes most of the features required by investors and day traders, while the Finviz Elite subscription features powerful features that give market participants a competitive advantage.

Out of several stock screeners, I would recommend Finviz. So, the Finviz review has come to its summary, and I hope you have found it worthy.